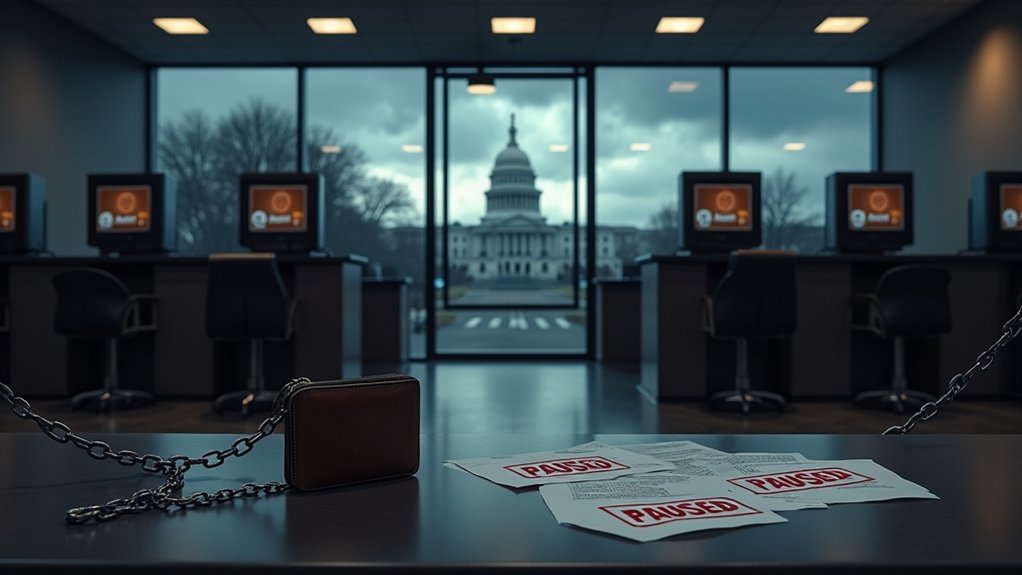

While the crypto industry fights for legitimacy, Biden’s FDIC has been quietly pulling the strings behind the scenes. Recently released documents reveal the regulator sent 25 “pause” letters to 24 banks interested in crypto activities. Not subtle, guys.

The FDIC is now scrambling to clean up its image, releasing 175 documents about its supervision of crypto-friendly banks. Acting Chairman Travis Hill admitted their approach created the perception they were “closed for business.” Ya think? The regulator knew about 96 institutions interested in crypto but seemingly did everything possible to discourage them. This release coincided with a Senate Banking Committee hearing on alleged debanking practices across the industry.

The FDIC’s belated transparency push reeks of damage control after systematically stonewalling nearly 100 crypto-curious banks.

Critics aren’t mincing words. They’re calling it “Operation Choke Point 2.0″—a coordinated effort to choke off banking services to crypto companies. Even Federal Reserve Chair Jerome Powell conceded “at least some” debanking claims were real. When Powell admits something’s up, you know it’s serious.

House Oversight Committee isn’t buying the FDIC’s sudden transparency kick. Chairman James Comer wants unredacted documents, especially those mysterious “pause letters” that allegedly pressured banks to dump crypto clients. This undermines the very financial inclusion that cryptocurrencies promise for unbanked populations. The Committee smells government overreach and they’re digging for proof.

Banks caught in the middle report facing endless delays—lengthy silences followed by repetitive information requests. Most gave up. Anchorage Digital Bank’s CEO confirmed crypto founders are struggling with widespread banking issues. No bank, big problem.

The FDIC claims it’s just concerned about risks—safety, soundness, financial stability. Fair points, given crypto’s wild ride lately. But their approach has been about as transparent as a brick wall.

Now Republican lawmakers want answers: What can the FDIC do without Congress? What requires legislation? They’re preparing to step in if regulators won’t play fair.

Meanwhile, the FDIC promises to replace its 2022 guidance and create pathways for safe crypto engagement. The agency is conducting a comprehensive review of supervisory communications related to digital assets. Better late than never. The crypto industry isn’t holding its breath.